Let’s be honest when most CPAs first hear “India accounting services,” they think about one thing: saving money on labor costs. And yes, that’s part of the story. But that’s not the whole story.

Over the past decade, something interesting happened in the accounting world. India went from being a novelty outsourcing destination to becoming the backbone of how American CPA firms operate during tax season and beyond. Not just a few adventurous firms trying it out. We’re talking about 89% of US accounting firms either actively using India accounting services or seriously considering it.

The reason? It’s not just about cheaper hourly rates (though that matters). It’s about something more powerful: India has become the epicenter of accounting expertise, technological capability, and professional infrastructure. When CPAs talk about why they work with Indian accountants, they mention reliability, turnaround times, specialized knowledge, and yes significantly lower costs. But in that order.

This guide pulls back the curtain on what’s actually happening with India accounting services. You’ll learn why this transformation happened and why it’s now mainstream.

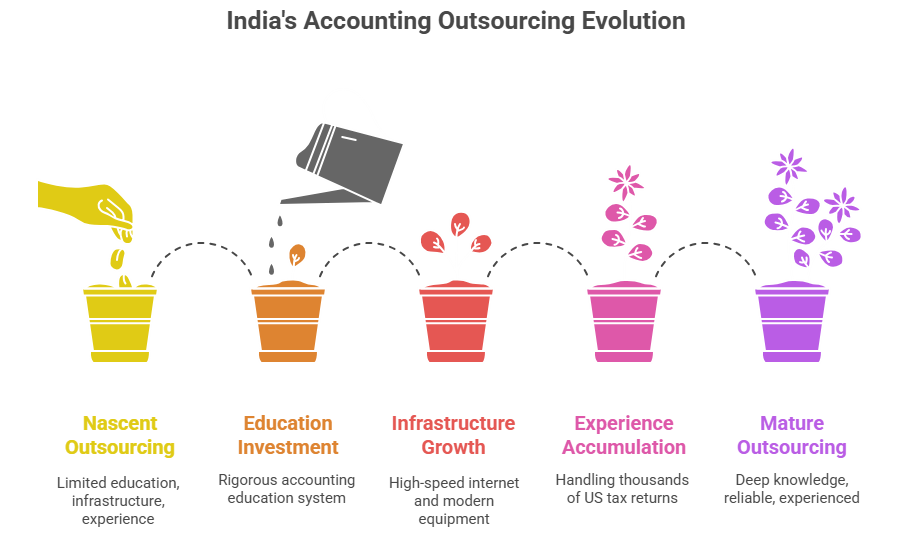

It Didn't Happen Overnight

Twenty years ago, outsourcing to India was risky. Most CPAs didn’t trust it. You heard horror stories about work quality and communication problems. Firms that tried it often came back disappointed.

Today? It’s mainstream. KPMG has massive accounting centers in India. Deloitte employs thousands of Indian accountants who handle US tax returns. Even boutique CPA firms that pride themselves on personalized service now rely on India-based teams during tax season.

Why Bookkeeping Services Are More Important Than Ever: Let us be honest – a lot of people think bookkeeping is just data entry. Type in some numbers, balance the ledger, done. That’s not what it is at all.

Real bookkeeping is about clarity. It’s about control. It’s about knowing exactly what’s happening with your money and being confident in every decision you make based on that information.

What Changed? Three Things:

1. India invested in education

The country has spent decades building one of the world’s most rigorous accounting education systems. The Chartered Accountant (CA) qualification in India is genuinely difficult the pass rate hovers around 5-10%. Compare that to the US CPA exam, which has about a 45-50% pass rate. Indian accountants going through that system don’t just know accounting they know it deeply.

2. Technology infrastructure matured

A decade ago, you couldn’t reliably work with someone in India because the internet connection wasn’t consistent enough. Now? Indian accounting professionals have the same high-speed connectivity and modern equipment you’d find in any US accounting office. They work with the same cloud tools, video conferencing software, and security systems that American firms use.

3. Actual experience built up

The early India outsourcing firms were learning as they went. By now, the established providers have handled hundreds of thousands of US tax returns. Their teams have seen every scenario, every complexity, every edge case. They don’t just know US tax law in theory they’ve lived it through thousands of real returns.

Why India Specifically?

1. Education Excellence

When you think about hiring someone from India to handle accounting, you might worry: “Are they properly trained?”

The answer is: often better trained than American entry-level accountants.

India’s CA qualification requires 4.5 years of formal education plus practical articles (apprenticeship) plus comprehensive exams. Many Indian professionals also hold CMA (Cost Management Accountant) certifications or have completed their B.Com (Bachelor of Commerce) degrees. What’s important: they’ve studied both Indian accounting standards AND US GAAP. They understand both worlds.

This matters because when you outsource tax returns to India, you’re not getting someone who barely passed their licensing exam. You’re getting professionals who’ve competed fiercely in one of the world’s most challenging accounting education systems.

2. Massive Talent Pool

Here’s something that matters more than it sounds: competition. With 2+ million qualified accountants in India and 400,000 graduating every year, accounting firms there can be incredibly selective about hiring.

This sounds like a problem (oversupply) but it’s actually fantastic for you. It means:

- When you work with a professional outsourcing firm, they’ve hired the best people they can find not just whoever was willing to take the job

- Specialized expertise is readily available (multi-entity returns, partnership accounting, international tax)

- Quality stays consistent because the talent pipeline never dries up

3. World-Class Technology Infrastructure

The popular myth: “India can’t handle modern cloud-based work.”

The reality: Indian tech professionals built many of the platforms everyone uses. Amazon, Microsoft, Google these companies have massive technical operations in India. Indian engineers contribute significantly to global technology.

For accounting professionals, this means they work with the same software you do (QuickBooks, Drake, Lacerte, cloud platforms). They use encrypted video conferencing. They manage secure data transfer. They understand cybersecurity protocols.

India isn’t “catching up” to American technology standards. In many ways, Indian firms have leapfrogged older infrastructure and jumped straight to modern cloud-based systems.

The Time Zone Advantage

India is 9.5 to 13.5 hours ahead of the US (depending on daylight saving time). Sounds complicated. Actually, it’s brilliant.

Here’s how it works in practice:

You hand off work at the end of your business day. Your India team works overnight on it. You wake up to completed work. For urgent situations a client needs a return finished for an evening meeting your offshore team can deliver 48-hour turnarounds that would be nearly impossible in a purely US-based operation.

It’s not just about speed either. It’s about flexibility. During tax season, when you’re drowning in work, you have an entire team working while you sleep. That extends your practical capacity without expanding your office or hiring permanent staff.

Conclusion

India’s rise to dominance in accounting outsourcing wasn’t accidental. It’s the result of decades of investment in education, technology infrastructure, and professional expertise.

The combination of rigorous accounting education, massive talent pool, world-class technology, favorable time zones, and proven track record has made India the obvious choice for US CPA firms looking to scale their operations efficiently.

FAQs

Answer:

India’s rise as the top accounting outsourcing destination happened gradually over the past 15-20 years. What started as a risky experiment in the early 2000s is now mainstream practice. Today, 89% of US CPA firms have either used or seriously considered India accounting services. Here’s how India built its dominance:

How India Became #1:

Invested heavily in world-class accounting education

Built reliable technology infrastructure and internet connectivity

Trained hundreds of thousands of accounting professionals on US tax requirements

Gained extensive experience handling millions of US tax returns

Proved the model works through consistent quality and fast turnarounds

Answer:

Many countries offer accounting outsourcing services. Philippines, Eastern Europe, and others all have accounting professionals. But India stands out for three critical reasons. No other destination combines all three advantages at this level.

Why India Dominates:

Unmatched education quality – Indian CAs have 5-10% pass rate (vs 45-50% for US CPA), creating exceptionally trained professionals

Massive talent pool – 2+ million qualified accountants with 400,000 graduating annually

Deep US expertise – Decades of experience specifically with US GAAP, IRS requirements, and Form preparation

Competitive pressure – Thousands of firms competing means only the best survive

Proven infrastructure – Systems specifically built for US accounting work

Answer:

A decade ago, India accounting services weren’t viable. The technology infrastructure wasn’t reliable enough. Internet connections were slow and inconsistent. Now? Technology is no longer the limiting factor. In fact, many Indian firms have better tech infrastructure than US accounting offices.

Technology Improvements That Changed Everything:

High-speed broadband is now standard in all accounting offices

Cloud-based tools (QuickBooks, Drake, Lacerte) are accessible worldwide

Video conferencing works smoothly across time zones

Encrypted file transfer and secure data centers are industry standard

- Cloud infrastructure eliminated need for on-site servers

Answer: The numbers might surprise you. We’re not talking about a small niche market. India has built an entire massive industry around US accounting work. The talent pool is deep, competitive, and growing every year.

The Market Size:

Over 2 million qualified accounting professionals in India

Approximately 400,000 new accounting graduates every year

Roughly 15-20% work specifically on US tax outsourcing

- Hundreds of thousands of Indian accountants handle US returns

Continuing to grow as more professionals enter the field

New firms launching regularly to meet demand