Worried about the wrong ERC or Incorrect Employee Retention credit Claim?

No worries now….!!

IRS Announced ERC Withdrawal Process to Protect Small Businesses and Organizations from the Heavy Effects of Interests and Penalties.

The ERC, or Employee Retention Tax Credit, is a refundable tax credit designed to support businesses that continued paying employees during the COVID-19 pandemic, even when operations were partially or fully suspended or faced significant declines in gross receipts. IRS has received approximately 3.6 million claims for the credit throughout the program.

With increased compliance reviews, the IRS announced the ERC Withdrawal Process to prevent fraud and to ensure that businesses avoid penalties and interest payments for claims filed by them that were filed under duress/ misinformation/ fraudulent greed as induced by ERC marketers or promoters into filing ineligible claims.

IRS Commissioner Danny Werfel said, “The IRS is committed to helping small businesses and others caught up in this onslaught of Employee Retention Credit marketing, The aggressive marketing of these schemes has harmed well-meaning businesses and organizations, and some are having second thoughts about their claims. We want to give these taxpayers a way out. The withdrawal option allows employers with pending claims to avoid future problems, and we encourage them to closely review the withdrawal option and the requirements. We continue to urge taxpayers to consult with a trusted tax professional rather than a marketing company about this complex tax credit.”

The key takeaways: ERC Withdrawal Process

Who can withdraw ERC claims?

- Employers who adjusted employment returns (Forms 941-X, 943-X, 944-X, CT-1X) only to claim the ERC. (i.e., Employers have not made any other adjustments)

- Employers who are willing to withdraw the entire amount of their ERC claim. (i.e. No Partial Withdrawals)

- Employers whose claims are still pending and are in the process of getting approval from the IRS.

- Employers whose claims are approved and who have received checks from the IRS, however, if their cheque is not yet cashed or deposited in their bank accounts.

Thus, for any other adjustments or partial withdrawal of claims, or if the claim amount is credited to the bank account of the employer, then, such employer cannot avail the benefit under the ERC Withdrawal process. For such scenarios, the employer needs to further amend their employment returns.

What are the Benefits of ERC Claim withdrawal?

- Claims are treated as if they were never filed and hence No Future Repayment of claims.

- IRS will not impose Interest and Penalties.

- If such claims are fraudulent claims filed wilfully, may not be exempt from potential criminal investigation.

- Even those who assisted in claiming such Tax Credit by fraudulent means are also liable for potential criminal investigation and prosecutions.

How to withdraw an ERC Claim?

- Employers who filed an application without any assistance from a payroll professional and didn’t receive any notice of an IRS audit can send an application by fax line at 855-738-7609 (Faster Processing) or by mail (Slower Processing of Applications).

- If the employers received notice for an Audit of the claim and the examiner is not assigned yet, the said employer can send a withdrawal application in response to the audit notice.

- If the ERC claim is under audit, and the examiner is assigned, the employer can ask the said examiner/officer to withdraw the ERC Application.

- If an ERC Claim is filed with the help of a professional, the professional should submit a withdrawal request to the IRS on behalf of the taxpayer.

- If the employer, receives an ERC check but has not cashed or deposited it, the employer can still send a withdrawal request. The employer needs to send the paper check along with the withdrawal of the ERC application, without stapling, bending, or paper clipping the check, to the IRS at the following address:

Cincinnati Refund Inquiry Unit

PO Box 145500

Mail Stop 536G

Cincinnati Refund Inquiry Unit

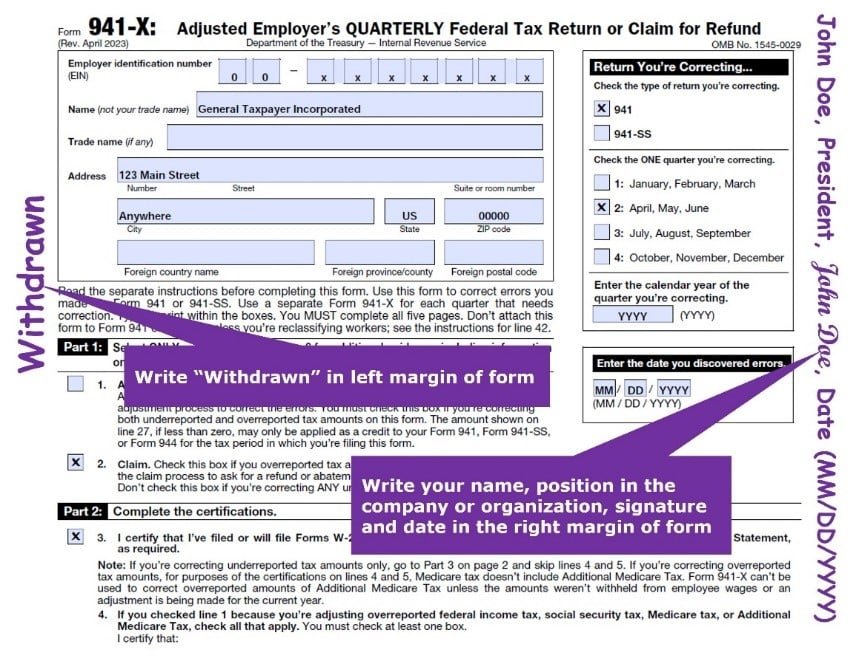

What to include with the ERC Withdrawal Process?

- Write a letter to the IRS mentioning “Do not process our entire Adjusted Employment Tax Return audit for the tax period that included your ERC Claim”. Also briefly explain the reasons for returning the ERC check.

- Take a copy of the Adjusted Tax Return that you wish to withdraw,

- In the left margin of the first page, write “Withdrawn” and

- In the right margin of the first page, Name, Title/Position in the Organization, Signature and Date shall be mentioned.

- If received a refund check, attach the refund check by writing “void” in the endorsement section on the back of the refund check.

The IRS’s recent move highlights its commitment to helping businesses affected by the constant marketing of the Employee Retention Credit. Small business owners are advised to thoroughly review the withdrawal option and requirements to avoid any potential issues in the future. It is recommended to seek guidance from a reliable tax professional regarding this intricate tax credit.