What You Need to Know about the FinCEN BOI Reporting

There are too many shady companies to which it’s difficult to figure out who actually owns them? Starting with January 1, 2024, A new rule called the Beneficial Ownership Information Reporting Rule (BOI Rule) is changing things.

Benefits of the FinCEN BOI Reporting

The BOI Rule’s impact extends far beyond mere compliance. It sets in motion a ripple effect of positive consequences:

- Reduced Money Laundering by making it harder for criminals to hide money.

- Enhanced National Security by helping authorities identify potential security risks.

- Fairer Competition by leveling the playfield for legitimate businesses.

- Increased Public Trust by promoting transparency and accountability in business.

To whom will this BOI Reporting Requirement not be Applied?

Most companies registering with a state government to start their business must follow the FinCEN BOI Reporting Requirement. You need to find your company in one of the following categories to determine whether this reporting applies to you.

Domestic Reporting company: a Corporation, Limited Liability Company (LLC), or Any Other Entity created by filing documents with a secretary of state or similar office.

Foreign Reporting company: a Corporation, LLC, or Other Entity formed under the law of a foreign country registered to do business in the United States by filing a document with a secretary of state or similar office.

Non-reporting companies: include entities not created by filing with a secretary of state, e.g., sole proprietorships and certain trusts.

Exempt companies: include Banks, Credit Unions, Tax-exempt Entities, Public Utilities, and Certain Large Companies. The small Entity Compliance Guide includes a full list of exemptions.

Following is the small flow chart, which explains whether your company is reporting company or not?

Who will be the beneficial owners of the company?

After determining whether your company falls under the reporting company category, you need to determine who will be your company’s beneficial owner.

A beneficial owner is any individual who, directly or indirectly:

Ownership Interests: Owns or controls at least 25 percent of the company’s owneship interests.Ownership Interests include equity, stock, or voting rights; a capital or profit interest; convertible instruments; options or privileges; and any other instrument, contract, or other mechanism used to establish ownership.

Exception to Ownership Interests: There are several exceptions to the definition of the beneficial owner, including a minor child, a nominee, an intermediary, a custodian, or agent, an employee, an inheritor, and a creditor.

Presentation showing ownership interest.

Or

Substantial Control: Exercises substantial control over a reporting company.

Below is the presentation of the persons who can have substantial control of the company

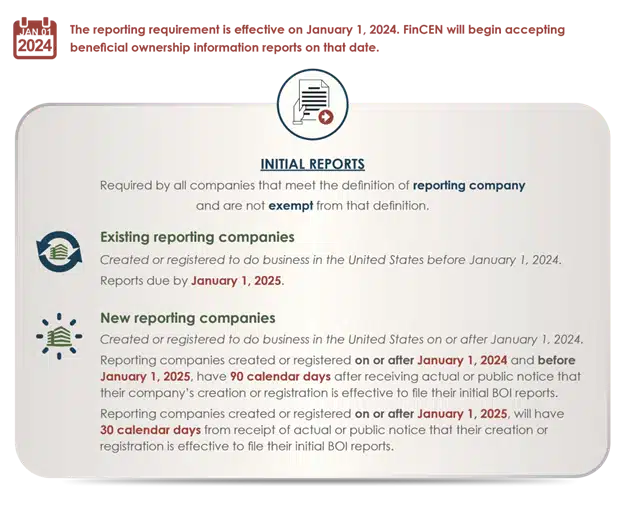

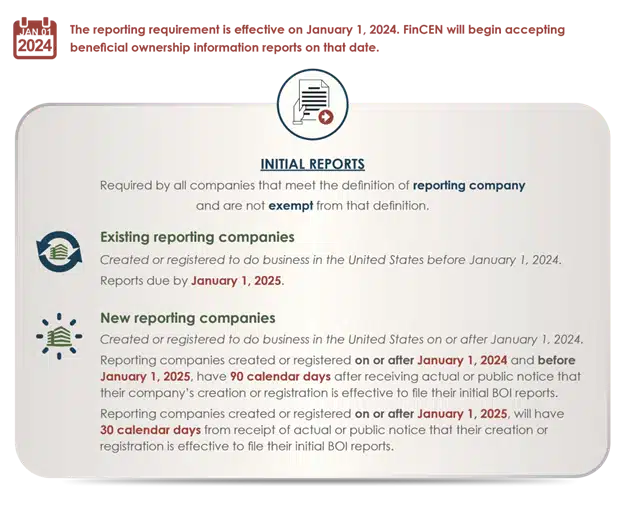

What is the due date to file a FinCEN BOI Reporting?

The reporting requirement is effective on January 1, 2024. There are two types of companies for reporting.

Existing reporting companies – Registered before January 1, 2024 – Reports due by January 1, 2025

New reporting companies – Registered before January 1, 2024 – Reports due within 90 calendar days.

What information do you need for FinCEN BOI Reporting?

Companies subject to the BOI Rule are required to disclose specific information about their beneficial owners, including:

Basic company information like legal name, trade name, Complete U.S. address, and taxpayer identification number or foreign tax ID.

Details of Beneficial Owners like Full Name (Ensuring clear identification of the individual behind the curtain), Date of Birth (An additional layer of identification verification), Address (Establishing residency and potential links to other entities), and Identification Number (Linking the beneficial owner to official documentation).

How Does FinCEN BOI Reporting Work?

Companies can conveniently file their BOI reports electronically through a secure system established by FinCEN. This user-friendly platform streamlines the process and ensures the safe and confidential transmission of sensitive information.This rule is a big deal! It makes businesses more honest, protects everyone from bad actors, and creates a fairer economy.

Consequences of non-reporting FinCEN BOI Reporting

FinCEN understands this is a new requirement. If you correct a mistake or omission within 90 days of the deadline for the original report, you may avoid being penalized. However, you could face civil and criminal penalties if you disregard your beneficial ownership information reporting obligations.

How can BusAcTa Advisors help with FinCEN BOI Reporting?

We provide offshore accounting and tax solutions services to US Accountants and Businesses, so we can take a load of this BOI Reporting, from Collecting Data from clients to submitting data to the FinCEN system. It’s clerical stuff, and so we are here to free you from all such type of work. We are the best executor supporting all your services, starting from Accounting, Bookkeeping, Tax Preparation, Payroll, Audit Support and Research services, so you can focus on serving clients better. Let’s have a call to find out how BusAcTa Advisors can help you file your BOI Reporting and make a cost-efficient accounting practice.

What You Need to Know about the FinCEN BOI Rule

There are too many shady companies to which it’s difficult to figure out who actually owns them? Starting with January 1, 2024, A new rule called the Beneficial Ownership Information Reporting Rule (BOI Rule) is changing things.

Benefits of this rule & reporting

The BOI Rule’s impact extends far beyond mere compliance. It sets in motion a ripple effect of positive consequences:

- Reduced Money Laundering by making it harder for criminals to hide money.

- Enhanced National Security by helping authorities identify potential security risks.

- Fairer Competition by leveling the playfield for legitimate businesses.

- Increased Public Trust by promoting transparency and accountability in business.

To whom will this rule not be applied?

Most companies registering with a state government to start their business must follow the BOI Rule. You need to find your company in one of the following categories to determine whether this reporting applies to you.

Domestic Reporting company: a corporation, limited liability company (LLC), or any other entity created by filing documents with a secretary of state or similar office.

Foreign Reporting company: a corporation, LLC, or other entity formed under the law of a foreign country registered to do business in the United States by filing a document with a secretary of state or similar office.

Non-reporting companies include entities not created by filing with a secretary of state, e.g., sole proprietorships and certain trusts.

Exempt companies include banks, credit unions, tax-exempt entities, public utilities, and certain large companies. The small Entity Compliance Guide includes a full list of exemptions.

Following is the small flow chart, which explains whether your company is reporting company or not?

Who will be the beneficial owners of the company?

After determining whether your company falls under the reporting company category, you need to determine who will be your company’s beneficial owner.

A beneficial owner is any individual who, directly or indirectly:

Ownership Interests: Owns or controls at least 25 percent of the company’s owneship interests.

Ownership Interests include equity, stock, or voting rights; a capital or profit interest; convertible instruments; options or privileges; and any other instrument, contract, or other mechanism used to establish ownership.

Exception to Ownership Interests: There are several exceptions to the definition of the beneficial owner, including a minor child, a nominee, an intermediary, a custodian, or agent, an employee, an inheritor, and a creditor.

Following is the presentation of the persons who will fall under the condition of having ownership interest

Or

Substantial Control: Exercises substantial control over a reporting company.

Below is the presentation of the persons who can have substantial control of the company

What is the due date to file a BOI Report?

The reporting requirement is effective on January 1, 2024. There are two types of companies for reporting.

Existing reporting companies – Registered before January 1, 2024 – Reports due by January 1, 2025

New reporting companies – Registered before January 1, 2024 – Reports due within 90 calendar days.

What information do you need to report?

Companies subject to the BOI Rule are required to disclose specific information about their beneficial owners, including:

Basic company information like legal name, trade name, Complete U.S. address, and taxpayer identification number or foreign tax ID.

Details of Beneficial Owners like Full Name (Ensuring clear identification of the individual behind the curtain), Date of Birth (An additional layer of identification verification), Address (Establishing residency and potential links to other entities), and Identification Number (Linking the beneficial owner to official documentation).

How Does Reporting Work?

Companies can conveniently file their BOI reports electronically through a secure system established by FinCEN. This user-friendly platform streamlines the process and ensures the safe and confidential transmission of sensitive information. This rule is a big deal! It makes businesses more honest, protects everyone from bad actors, and creates a fairer economy.

Consequences of non-reporting BOI

FinCEN understands this is a new requirement. If you correct a mistake or omission within 90 days of the deadline for the original report, you may avoid being penalized. However, you could face civil and criminal penalties if you disregard your beneficial ownership information reporting obligations.

How can BusAcTa Advisors help in this reporting?

We provide offshore accounting and tax solutions services to US Accountants and Businesses, so we can take a load of this BOI Reporting, from Collecting Data from clients to submitting data to the FinCEN system. It’s clerical stuff, and so we are here to free you from all such type of work. We are the best executor supporting all your services, starting from Accounting, Bookkeeping, Tax Preparation, Payroll, Audit Support and Research services, so you can focus on serving clients better. Let’s have a call to find out how BusAcTa Advisors can help you file your BOI Reporting and make a cost-efficient accounting practice.