Many find that the ever-increasing expense of college is an impassable financial barrier. Thankfully, there is assistance available through the American Opportunity Tax Credit (AOTC). The AOTC will be explained in this blog, along with its benefits, conditions, documents required, and FAQs on the AOTC. Also, we explained how the American Opportunity Tax Credit (AOTC) is better than the Life Time Learning Credit (LTLC).

What is the American Opportunity Credit?

The American Opportunity Credit is a tax credit designed to help individuals and families afford higher education expenses. Whether you are using student loans or personal savings to pay for college, this credit can provide significant financial assistance. It can be claimed each year that you meet the eligibility requirements, making it a valuable resource for those pursuing post-secondary education.

How much is the American Opportunity Credit worth?

The AOTC offers a maximum annual credit of $2,500 per eligible student. Here’s the breakdown:

- 100% of the first $2,000 of costs plus

- 25% of the next $2,000 of costs

For example, if a student incurs $4,000 in qualifying expenses in a year, they could potentially receive the full $2,500 credit. This can help offset the cost of tuition, textbooks, and other necessary expenses for their education.

The above credit is per eligible student, so you can thus be eligible for a credit of up to $5,000 if you have twins who are first-year college students.

The American opportunity credit is based on the fulfillment of certain requirements; do not claim the lifetime learning credit.

Qualification Conditions:

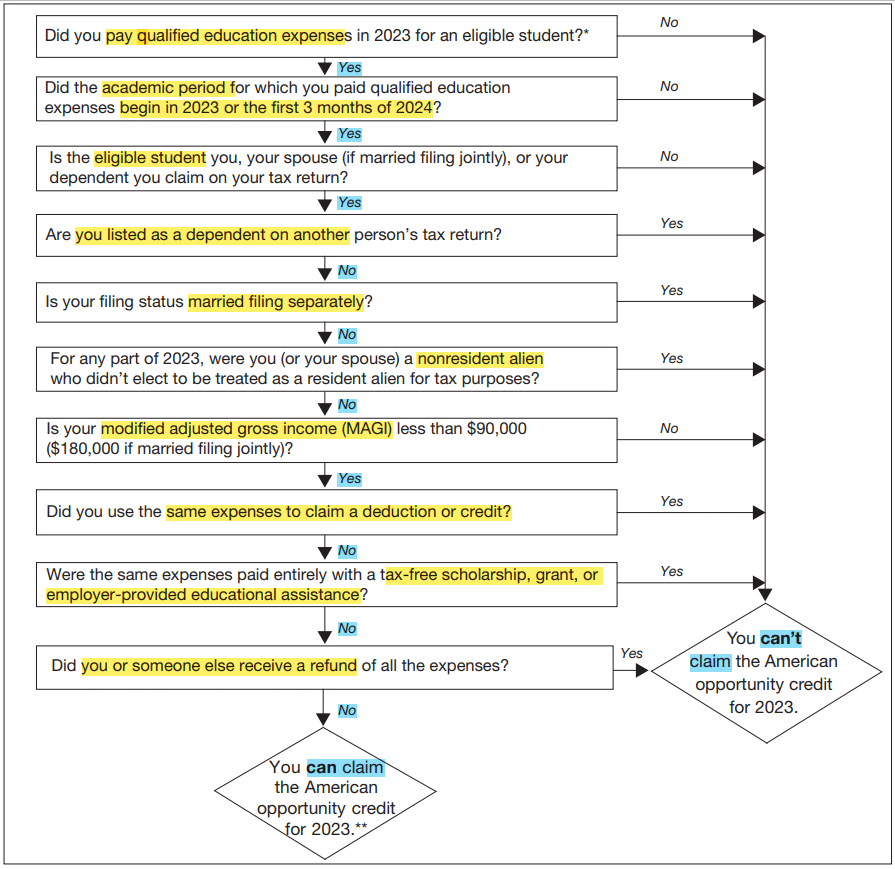

You have to fulfill all five of these requirements to be eligible for the American Opportunity Credit:

⮞ Payments cover the first four years of higher education.

⮞ A qualifying student is the beneficiary of the payments.

⮞ An eligible institution receives payment.

⮞ Payments cover eligible expenses for postsecondary education.

⮞ You are not over a predetermined amount in modified adjusted gross income.

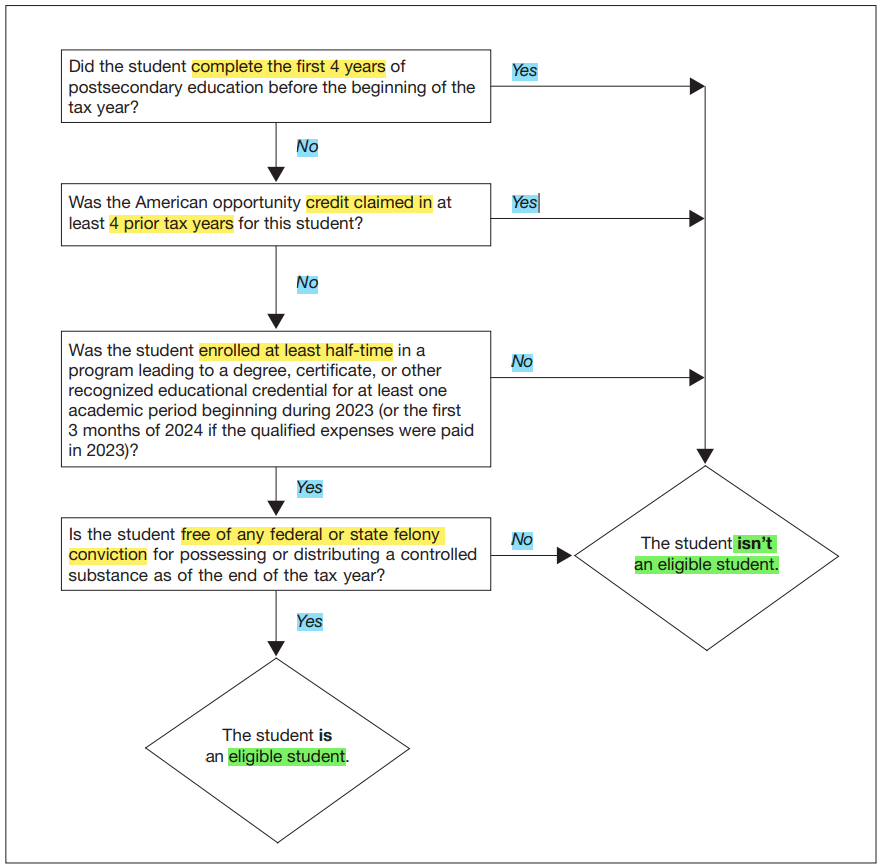

1. The First 4 Years of Higher Education

The first four years of college or another type of postsecondary education will qualify for the credit. If a student takes five years or longer to complete their college degree, then they are only eligible to receive the American opportunity credit for the first four years of their higher education.,

For example, if a student attends a university for four years and completes their degree within that timeframe, they would qualify for the American Opportunity Credit. However, if the same student decides to pursue a double major or take additional classes that extend their education beyond four years, they would no longer be eligible for the credit after the fourth year.

2. Eligible Students

You can claim the credit on your return for yourself, your spouse, or the dependent for whom you claim an exemption. The student must enroll for at least one academic term (a semester, trimester, or quarter) during the year.

3. Selection of Educational Institutions

You cannot claim the credit unless you make payments to an approved institution. This covers every recognized proprietary, nonprofit, or public university qualified to take part in the U.S. Department of Education’s student aid programs. You will therefore most likely not be able to claim this tax credit if you enroll in a foreign university or school. If in doubt, find out at www.studentaid.ed.gov or ask your school to check for recognition.

Degrees, certificates, or other official educational credentials must result from enrollment.

4. Qualified Higher Education Costs

It includes tuition fees, associated fees, books, supplies, and required equipment. Related fees can be anything, like a student activity fee that is paid to the university if it is mandatory for all students. It should not include anything that goes toward personal spending. Hobby or sports courses and noncredit courses do not count toward a student’s degree program.

The expenses listed below are not eligible for the credit.

⮞ Any expenses paid with tax-free educational assistance,

⮞ Room and board (even if paid to the institution as a condition of enrollment)

⮞ Medical expenses

⮞ Transportation

⮞ Insurance

⮞ Personal living expenses

If a computer is required for school attendance, its cost might be eligible for credit. If not, it is considered a personal expense for which credit cannot be applied.

What are the documentation requirements?

The school provides the student with an information return that lists eligible tuition and associated costs paid for the year. Typically, you have to have received Form 1098-T, the Tuition Payments Statement, to be eligible for the credit.

Do I need a Form 1098-T to claim the American Opportunity Credit?

To claim the American Opportunity Credit (AOTC), you must have received Form 1098-T, Tuition Statement, from an eligible educational institution. However, you can claim AOTC even if you don’t have Form 1098-T. In such cases, you should keep records that show

⮞ You were enrolled at an eligible educational institution and

⮞ The amount paid for qualified related expenses.

If your educational institution is closed or you have other valid reasons for not having Form 1098-T, you can still file and claim the AOTC by putting tuition and fee costs in your tax return and attaching a note explaining the absence. It’s important to have the proper documentation to support your AOTC claim because the IRS may audit your return and penalize you if your claim is found to be incorrect.

How do I report the American Opportunity Credit on my tax return?

The American opportunity credit is calculated on Form 8863, Education Credits. The refundable portion of the credit is then shown on line 29 of Form 1040 or 1040-SR, and the nonrefundable portion of the credit is entered on Schedule 3 of Form 1040 or 1040-SR.

Modified Adjusted Gross Income (MAGI) Limit

Your modified adjusted gross income (MAGI) determines the amount of tax credit you can take. For this purpose, MAGI is gross income increased by other foreign items and the exclusion of foreign earned income.

You can claim the entire tax credit if your MAGI is below a phaseout range; those with MAGI within the range are eligible for a partial credit. Should MAGI rise above the range, no credit can be reclaimed.

| Filling Status | MAGI Limit |

| Married Filing Jointly | $160,000 – $180,000 |

| Other filing status | $80,000 – $90,000 |

Note: Married Filing Separately cannot claim this credit.

Can we claim expenses that are paid with distributions from a 529 Plan or Coverdell Education Savings Account (ESA)?

The credit can be combined with any other education tax credits you might be eligible to claim. The credit is refundable in the year in which you get distributions from a 529 Plan or Coverdell Education Savings Account (ESA). The expenses used to determine the tax-free portion of the distributions cannot be the same on which you received other benefits, distributions, or credits.

For example, you paid the annual college tuition for your child of $15,000. $5,000 of this amount comes from a 529 plan distribution, and then you can claim only $10,000 of qualifying expenses for the credit calculation ($5,000 is a tax-free distribution from the 529 plan).

Can I claim the American Opportunity Credit if I receive a scholarship or grant?

Even if you are awarded a scholarship or grant, you may still be eligible to claim the American Opportunity Tax Credit (AOTC). However, scholarships and grants are typically exempt from taxation, which means that they reduce the amount of qualified education expenses that can be used to claim the credit.

In order to calculate the AOTC, your qualified education expenses, which include tuition, fees, and books and supplies related to the course, are taken into consideration. There is a reduction in the amount of credit that you are able to claim if you use scholarships and grants to pay for these qualified expenses.

Strategy to consider:

There is an option for you to report a portion of the grant or scholarship that you have received as taxable income. This makes it possible for you to claim the AOTC on the portion of the scholarship that was used to pay for expenses that meet the criteria. However, this strategy involves trade-offs;

⮞ Increased Taxable Income: Reporting income from scholarships raises the amount of income that is subject to taxation, which may result in you being placed in a higher tax bracket.

⮞ Maximizing AOTC: It gives you the opportunity to claim credit on the amount of the scholarship that was reported and used for expenses that are eligible.

How is the American Opportunity Credit different from the Lifetime Learning Credit?

The American Opportunity Credit (AOTC) and the Lifetime Learning Credit (LTLC) are two education tax credits available to taxpayers, but they have some key differences:

- Eligibility Period:

- Qualification:

- Credit Amount:

- Number of Courses:

- Felony drug conviction:

- Qualified Expenses:

⮞AOTC: Only for the first 4 years of post-secondary education.

⮞LTLC: Available for all years of post-secondary education, including graduate school and courses to acquire or improve job skills.

⮞AOTC: The student must be pursuing a degree or recognized education credential and be enrolled at least half-time.

⮞LTLC: There is no requirement for the student to be pursuing a degree or to be enrolled at least half-time.

⮞AOTC: It is worth up to $2,500 per eligible student and is 40% refundable.

⮞LTLC: It is worth up to $2,000 per tax return and is not refundable.

⮞AOTC: Requires the student to be enrolled at least half-time for at least one academic period beginning in the tax year.

⮞LTLC: Available for one or more courses.

⮞AOTC: Students with felony drug convictions are ineligible.

⮞LTLC: Felony drug convictions do not affect eligibility.

⮞AOTC: Includes tuition, required enrollment fees, and course materials needed for the course of study.

⮞LTLC: Includes tuition and fees required for enrollment or attendance. Credit might not be eligible for course materials.

Keep in mind that you are able to claim both of these benefits on the same tax return; however, you cannot claim them for the same student or for the same qualified expenses. With regard to your circumstances, it is essential to select the option that offers the greatest potential tax benefit.

BusAcTa Advisors is a business, accounting, and tax advisory firm that can help you navigate the complexities of tax credits like the American Opportunity Tax Credit (AOTC) and the Lifetime Learning Credit (LLC). We can provide guidance on which option offers the greatest potential tax benefit based on your specific circumstances. With our expertise, you can ensure that you are maximizing your tax savings while staying compliant with IRS regulations. For more personalized assistance, contact us at info@busacta.com.

Frequently Asked Questions (FAQs) on AOCT:

Answer: Even if you pay for qualifying expenses with loan proceeds, you can still be eligible for the credit.

Answer: You can also claim the credit if someone other than you, your spouse, or your dependent pays for eligible expenses, such as the student’s grandmother. Since the payment is regarded as having been made by the student and as your dependent, you are entitled to the credit if you meet all other requirements.

Answer: Yes, parents can claim the American Opportunity Credit (AOTC) for their child if the child is dependent on their tax return. However, the child must meet the qualification criteria for AOTC.

Answer: Yes, there are income limits for claiming the American Opportunity Credit (AOTC). These limits are based on your Modified adjusted gross Income (MAGI) which you can find in the above blog.

Answer: The American Opportunity Credit (AOTC) can only be claimed for a period of time that is equal to four years’ worth of taxes. It is necessary to have been enrolled in school at least half-time for at least one academic period during the tax year in question in order to be eligible to claim the credit during that particular tax year.

Answer: If you take online classes that satisfy the requirements established by the Internal Revenue Service (IRS), then you are eligible to claim the American Opportunity Tax Credit (AOTC).

- Eligible Educational Institution: The courses must be provided by an eligible educational institution. This includes accredited colleges, universities, vocational schools, and community colleges that grant degrees or other recognized educational credentials.

- Academic Program: The online courses must be part of a degree or other recognized educational credential program.

- Enrollment Status: You must be enrolled at least half-time for at least one academic period in the fiscal year.

Answer: Yes, you can claim the American Opportunity Tax Credit (AOTC) even if you are a part-time student, as long as you meet certain criteria as listed above.